Students who are planning to learn and understand the topics of MP Board Class 12th Accountancy Important Questions Chapter 9 Analysis of Financial Statements for free from this page. Make sure you use them as reference material at the time of preparation and as a good grade in the final exam. Students who find it difficult to learn English concepts can take the help of this MP Board Class 12th Accountancy Important Questions Chapter 9 Analysis of Financial Statements PDF and answer all questions in the exam easily. Go through the below sections and get the MP Board Class 12th Accountancy Important Questions Chapter 9 PDF. Students can also download MP Board 12th Model Papers so that you can revise the entire syllabus and get more marks in your exams.

Table of content (TOC)

MP Board Class 12th Accountancy Important Questions Chapter 9 Analysis of Financial Statements

Analysis of Financial Statements Important Questions

Analysis of Financial Statements Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Under which financial analysis, data of two or more than two years are written together for comparative study :

(a) Horizontal analysis

(b) Vertical analysis

(c) Cash analysis

(d) Ratio analysis.

Answer:

(a) Horizontal analysis

Question 2.

The analysis in which one figure is compared with an other figure and which shows the relationship between the two is called:

(a) Break even analysis

(b) Ratio analysis

(c) Trend analysis

(d) General analysis.

Answer:

(b) Ratio analysis

Question 3.

Break even point depicts:

(a) Profit

(b) Loss

(c) No profit no loss

(d) Gross profit.

Answer:

(c) No profit no loss

Question 4.

Analysis of reasons for changes in cash is:

(a) Fund flow statement

(b) Cash flow statement

(c) Trend Analysis

(d) None of these.

Answer:

(b) Cash flow statement

Question 5.

The main objective of financial statement analysis is:

(a) To know about profitability

(b) To check the financial statement

(c) To satisfy various interest holders

(d) To full fill the formalities.

Answer:

(a) To know about profitability

Question 2.

Fill in the blanks:

- The point at which total cost is equal to total revenue is called ……………

- The analysis depicting the changes in working capital during the year is called ……………

- The method of financial analysis in which the relationship between various items of balance sheet and profit /

- loss account is established is called …………… analysis.

- Only such information are included in financial statement which can be expressed in terms of ……………

- The analysis which is used to judge the trend of operations of an enterprise and computed in relation to a base year is called ……………

Answer:

- Break even point

- Fund flow analysis

- Vertical

- Money

- Trend analysis.

Question 3.

Match the columns:

Answer:

- (b) Disclosing natural relationship by comparative study of mathematical expression

- (a) To represent the changes in working capital

- (c) Cash flow analysis and use of cash

- (e) Break even as point.

- (d) Trend analysis no profit and no loss

Question 4.

Write true or false:

- Liquidity ratio refers to establishing relationship between current assets and current liabilities.

- Fund flow statement does not represent the changes in working capital.

- The point at which total cost is equal to total revenue is called break even point.

- The position of cash balance and various uses of cash cannot be known through cash flow analysis.

- The trend various items can be expressed in terms of percentage through trend analysis.

Answer:

- True

- False

- True

- False

- True.

Question 5.

Write the answer in one word/sentence:

- The method of reviewing and analysing financial statements for a specific period.

- The other name of vertical analysis is.

- The analysis which represent the trends of various items in form of percentages is called as.

- The ratio which discloses relationship between current assets and current liabilities is called.

- The point at which total cost is equal to total revenue is called.

Answer:

- Vertical analysis

- Common size analysis

- Trend analysis

- Liquidity ratio

- Break even point.

Analysis of Financial Statements Very Short Answer Type Questions

Question 1.

What do you mean by analysis of financial statements ?

Answer:

Analysis of financial statements is a process in which the data of various head are compared so as to,-find out a relationship in an effective manner by classifying them in a simple form so that significant result may be obtained regarding financial strength or weakness of the company. The process of analysis and interpretation of financial statements help in deriving important conclusions and knowledge about business operations.

Question 2.

Write three characteristics of analysis of financial statements ?

Answer:

The following are the three characteristics of financial statements :

- To represent the complex data present in financial statements in a simple form.

- To divide the various items of financial statements under clear and appropriate heads.

- To compare various items so as to find out changes among them and help in taking out appropriate inferences.

Question 3.

What do you mean by comparative statements ?

Answer:

The statements is which figures for two or more year are places side-by-side to facilitate comparison are called comparative statements. The figures pertaining to production, expenditure, sale profit etc. are shown comparatively side by side so as to draw conclusions about the profit earning capacity liquidity profitability and financial soundness of the concerning business.

Question 4.

What is fund flow Statement?

Answer:

Fund flow statement is a statement prepared in a summary form which brings into light the cause of changes in working capital during the year. Such statements comprises the sources of funds, uses of funds and the changes in net working capital. This statement also reach the various sources from where the firm received funds and the areas in which these funds were utilized.

Question 5.

What is cash flow analysis ?

Answer:

Cash flow analysis shows inflows and outflows of cash in a concern during a particular accounting period. Cash means cash and cash equivalents, while flow means movement of cash. It explains reasons for the changes in cash position of an enterprise. This analysis helps the managers / directors to find out why there was scarcity of cash in business despite. The firm earned profit and why there is cash balance available despite the firm incurred loss.

Question 6.

What is break even point analysis ?

Answer:

The term break even point refers to that point at which the total cost are just equal to total sales. A business concern neither earns profit nor suffers a loss at this point. It is also called Neutral point.

Question 7.

Name the different tools of financial analysis.

Answer:

The following tools or devices are used for financial analysis :

- Comparative financial statement.

- Trend analysis.

- Common size statement.

- Fund flow statement.

- Cash flow statement.

- Ratio analysis.

- Break even point analysis.

Question 8.

What do you mean by liquid assets ?

Answer:

Liquid assets refers to that assets which can be converted into cash without any diminution in the value of asset for example cash in hand, cash at bank (these two assets are itself liquid), bill receivable and short investment. For calculating liquid asset from current asset stock and prepaid expenses left out.

Analysis of Financial Statements Short Answer Type Questions

Question 1.

Explain objectives of financial statement analysis.

Answer:

The following are the main objectives of financial statement analysis.

1. Knowledge of earning capacity or profitability of business:

The main object of analysis is to know whether there is appropriate profit on invested capital or not. It enables computation of earning capacity of the business and estimation of future earning capacity as well.

2. Knowledge regarding solvency:

The financial analysis helps to determine the short-term as well as long form solvency of the concern.

3. Knowledge of financial position:

Analysis of financial statement enables us to know the financial strength of the business enterprise. Through analysis of financial statement we can ascertain whether requisite funds will be available for purchasing fined assets from integrate resources of business or not.

4. To know about capability of payment of interest and dividend:

Through analysis of financial statement we can easily ascertain the capability of business under taking to pay interest and dividend regularly. We can ascertain whether there is sufficient profit for this purpose.

5. Knowledge of trend of business:

Analysis of financial statements help us to make a comparative study of balance sheets of business of various years. The trends of purchase, sale gross profit etc. can be easily compared with that of previous year. Such compression help us to investigate the weakness, irregularity and remedial measures can be taken for improvement.

6. Valuable information for management:

One of the principal objective of the analysis of financial statement is to know the weakness or drawbacks of the undertaking. This analysis makes valuable data and information available to the management for further decision and planning.

Question 2.

Explain the importance of analysis of financial statements.

Answer:

Financial analysis is usually significant to the following categories of persons:

1. Significance for management:

The management needs to know what progress of

business has been towards its objectives of profitability, economic soundness turned etc. it is from the analysis they can be made available. On the basis of facts of analysis the management is able to compare the business with other business. Financial analysis reveals the shortcomings which can be removed by making effective policies. ‘

2. Significance for investors:

Investors invest their money with the expectation of a good return. They take decision on the basis of information disclosed for profitability, solvency and trend of business. They can compare the business with other business and the analysis of current year with previous year of the same business and finalize their plans regarding investment.

3. Significance for creditors and debenture holders:

Short term creditors are interested to know liquidity position of the business. This can be obtained through solvency ratios. Similarly the long – term creditors particularly debenture holders want to know the timely return of interest on debentures and the security of money invested in the form of debentures. They can obtain the knowledge regarding long-term solvency of the company through the analysis of the financial statements.

4. Significance for Government:

Government has to take various decisions for the economic development of the country. Government frames the industrial policy. The financial analysis is helpful for the formation and execution of financial and economic policies of Government.

5. Significance for financial institutions:

Financial institutions play important role in industrial and commercial development. Bank, life insurance corporation, ICICI bank, HDFC bank. Industrial development bank advance mid term and long – term loan to business concerns. For deciding the rate of interest, return of loan etc. they take the help of analysis of financial statements.

6. Significance for others:

Financial analysis has importance to other categories of society. The employees are interested to know the profitability of concern. On this basis they can demand for increase in salary. Economists, researches, analysts, tax authorities also receives the useful information through analysis of financial statements of business concerns.

Question 3.

Explain the limitations of financial statement analysis.

Answer:

The following are the limitations of financial statement analysis:

1. Limitations of financial statements:

Financial statement themselves have a number of limitations and so the analysis of financial statements suffers from limitations. Financial statement in fact, are based on accounting concepts and communications and so the analysis of such statement clear not prove meaningful.

2. Affected by window dressing:

It is generally seen that window dressing is adopted in financial statements to conceal the bad aspect of financial position. It adversely affects then analysis of financial statements.

3. Based on past events:

Financial statements represents the record of part events and historical facts. It is based on previous year data and events. The result of financial analysis can not disclose the possibilities of future. Hence, the conclusions derived from them can not be used for the purpose of forecasting.

4. Ignores the changes in price level:

If price level changes are not taken into consideration, the results of analysis of financial statements may be misleading Ratios of different years will not be useful for comparison if the prices of commodities are different. The ratios may improve due to increase in prices whereas the actual efficiency remains unchanged. Correct results of two financial years can be obtained when the price one. Stable other set the result of analysis of financial statement may be misleading.

5. Effect of personal decision of analysts:

Analysis of financial statements are affected by personal decisions taken by accountants analysts themselves such as methods of charging depreciation valuation of stock, writing off revenue expense’s etc The rationality of such decisions depends upon the ability, honesty and experience of the analysts. Thus, financial statements and conclusions derived from then may be biased.

6. Ignores the qualitative element:

Analysis of financial statements does not measure the qualitative aspects of business concern. It disclose only those information which can be expressed in terms of money. It does not exhibit the skill, technical know how and efficiency of staff and management. Hence the analysis is one-sided measure. It shows one sided performance of a business undertaking.

7. Limited use of single year’s analysis of financial statements:

If analysis of financial statements is done for one year then from that analysis correct conclusion cannot be taken. Hence, it is necessary to analysis financial statements of few years.

Question 4.

Write the characteristics of analysis of financial statement

Answer:

Following are the characteristics of financial analysis:

- To present the accounting data in a simple and understandable form.

- To classify the items of profit and loss account and balance sheet in convenient and related groups.

- To make comparison between different groups to interpret different conclusions.

- Financial analysis clarify the changes in the financial items.

- There are various techniques for financial analysis.

Question 5.

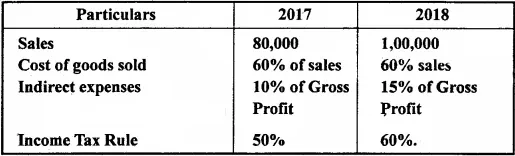

Prepare comparative Income statement from the following particulars for the year ended 31st March 2017 and 31st March 2018.

Solution:

Comparative Income Statement

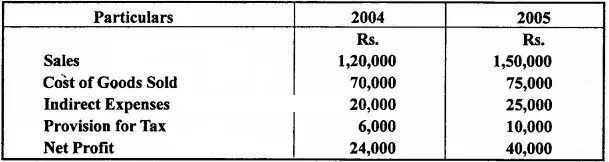

Question 6.

From the following details make out a comparative income statement:

Solution:

Comparative Income Statement

Question 7.

From the following information prepare a comparative statement for the year ended 31st March 2008 and 31st March 2009.

Solution:

Comparative Income Statement For the year ended 2008 and 2009:

Final Words

So friends, how did you like our post! Don't forget to share it with your friends below the sharing button post. Apart from this, if there is any problem in the middle then do not hesitate to ask in the comment box. We will be happy to assist you. We will keep writing more posts related to this. So don't forget to bookmark (Ctrl+D) our blog “various info: Education and Tech” on your mobile or computer and subscribe us now to get all the posts in your email.

If you liked this post then don't forget to share it with your friends. You can help us reach more people by sharing it on social networking sites like WhatsApp, Facebook or Twitter. Thanks!

If you liked the information of this article, then please share your experience by commenting. This is very helpful for us and other readers. Thank you