Students who are planning to learn and understand the topics of MP Board Class 12th Accountancy Important Questions Chapter 8 Financial Statements of a Company for free from this page. Make sure you use them as reference material at the time of preparation and as a good grade in the final exam. Students who find it difficult to learn English concepts can take the help of this MP Board Class 12th Accountancy Important Questions Chapter 8 Financial Statements of a Company PDF and answer all questions in the exam easily. Go through the below sections and get the MP Board Class 12th Accountancy Important Questions Chapter 8 PDF. Students can also download MP Board 12th Model Papers so that you can revise the entire syllabus and get more marks in your exams.

Table of content (TOC)

MP Board Class 12th Accountancy Important Questions Chapter 8 Financial Statements of a Company

Financial Statements of a Company Important Questions

Financial Statements of a Company Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Following are included in the financial statement of a commercial firm:

(a) Balance Sheet

(b) Profit & Loss statement

(c) Cash flow statement

(d) All of these.

Answer:

(d) All of these.

Question 2.

The General methods adopted for financial analysis are:

(a) Horizontal Analysis

(b) Vertical Analysis

(c) Ratio Analysis

(d) All of these.

Answer:

(d) All of these.

Question 3.

Annual Report of a company is issued for:

(a) Director

(b) Auditors

(c) Shareholders

(d) Management.

Answer:

(c) Shareholders

Question 4.

Comparative Analysis is also known as:

(a) Active Analysis

(b) Horizontal Analysis

(c) Vertical Analysis

(d) External Analysis.

Answer:

(b) Horizontal Analysis

Question 5.

Balance Sheet of a firm disclose the information related to financial condition for:

(a) A specific given period

(b) During a specific period

(c) A specific period

(d) None of these.

Answer:

(a) A specific given period

Question 6.

In which meeting is it compulsory for a company to produce it’s balance sheet and profit and loss account compulsory:

(a) Extra ordinary general meeting

(b) Debenture, holder’s meeting

(c) Annual general meeting

(d) Meeting of board of directors.

Answer:

(c) Annual general meeting

Question 7.

Which of the following is prepared in horizontal or vertical format:

(a) Profit and loss account

(b) Balance sheet

(c) Income and expenditure account

(d) Cash account.

Answer:

(b) Balance sheet

Question 8.

Which of the following capital is not included for totaling of balance sheet:

(a) Paid – up capital

(b) Issued capital

(c) Authorised capital

(d) Share capital.

Answer:

(c) Authorised capital

Question 9.

Which of the following liability is shown below the balance sheet separately :

(a) Current liability

(b) Fixed liability

(c) Contingent liability

(d) Overdraft.

Answer:

(c) Contingent liability

Question 10.

The amount of preliminary expenses and underwriting commission in shown under which heading and which side of balance sheet:

(a) Liability side

(b) Assets side under the head of miscellaneous expenses

(c) None of the sides

(d) None of these.

Answer:

(b) Assets side under the head of miscellaneous expenses

Question 2.

Fill in the blanks:

- Generally analysis mean …………….. of data.

- Meaning of formulation is …………….. of data.

- Comparative Analysis is also known as …………….. analysis.

- The General form of analysis is also known as …………….. analysis.

- The actual inflow and outflow of cash in an organization / institution is known as …………….. analysis.

- Underwriter is that person, firm or company who promises to …………….. the shares of a company.

- The part of profit which is kept for unforeseen exigencies of future is called ……………..

- The part of profit which is kept for distribution to shareholders is called as ……………..

- The dividend which is proposed for distribution by company in the following year is called ……………..

- The arrangement of employees provident fund is called as ……………..

Answer:

- Simplification

- Described

- Horizontal

- Vertical

- Cash flow

- Purchase

- Reserve

- Divisible profit

- Proposed dividend

- Provision.

Question 3.

Match the columns:

Answer:

- (a) Underwriter

- (c) Expenses incurred during formation of company

- (b) External liability of a company

- (e) The amount which has not been claimed by shareholders.

- (d) Amount which is kept for distribution to share holders

Question 4.

Write true or false:

- Cash flow statement is included in the financial statement of a commercial organization.

- Comparative statement is a form of horizontal analysis.

- Ratio analysis establish relation between two financial statements.

- Financial analysis are used by the creditors only.

- The financial analysis provide assistance to derive the accurate decision to the analyse.

- Preliminary expenses are incurred during dissolution of a company.

- Discount on issue of shares and debentures are shown is assets side of balance sheet.

- Preliminary expenses are considered as capital expenditure.

- The balance sheet of a company is prepared as per schedule VI and part I of company’s act 1956.

- Preparation of balance sheet is not mandatory for a company.

Answer:

- True

- True

- True

- False

- True

- False

- True

- False

- True

- False.

Question 5.

Write the answer in one word / sentence:

- Which are the two basic financial statement of a company ?

- What are non current Assets ?

- Give two examples of current liabilities.

- What is contingent liabilities ?

- Write two items of the heading ‘Provision’.

- The capital beyond which the company cannot issue it’s shares.

- The person who promotes a company ?

- The capital which has been received by the company ?

- What condition of a company is disclosed by balance sheet of company ?

- Which type of expenditure is underwriting commission ?

Answer:

- Profit & Loss A / c, Balance Sheet

- Assets kept for more than one year

- Creditors, Bills Payable

- Liabilities which depend on the occurrence of certain event in fixture

- Provision for Taxation, Provision for Divident

- Authorised capital

- Promoters

- Paid-up capital

- True and correct

- Deferred Revenue expenditure.

Financial Statements of a Company Short Answer Type Questions

Question 1.

What do you mean by contingent liabilities ? Give two examples of it

Answer:

These are liabilities which will exist or not, it will depend on any future incident. They are not shown in the liability side of balance sheet. But they are shown below the balance sheet as a foot note. These are the claims of companies outside parties. It can’t be accepted as a loan.

Example:

Amount of bills discounted from the bank, partial payment of shares, etc.

Question 2.

Give the definition of financial statement and five examples of fixed assets.

Answer:

The financial statements are those statements which are prepared to ascertain the profit or loss during an accounting period and position of assets and liabilities at a certain date. These statements are the outcomes of the summarizing process of accounting and are the sources of information based on which conclusion are drawn about the profitability and financial position of a company definitions:

John N. Myer:

‘The financial statement provide a summary of account of a business enterprises, the balance sheet reflecting the assets, liabilities and capital as on a certain date and the income statement showing the results of operations during a certain period.”

As per the Companies Act 2013:

‘‘Financial statement will present a true and appropriate view of the positioning details to the company or companies when it will follow the schedule writing in Section 133 and in the prescribed format of Schedule III of the Act.”

Fixed Assets:

“These are those assets which are used in the business for long duration such as land and buildings, plant and machinery, Furniture, Vehicles, Livestock, Goodwill, Trademark, patent etc.

Question 3.

What do you mean by current assets ?

Answer:

Current assets:

Under this heading we include all such assets which are expected to be converted in cash within a year from the date of balance sheet. The items that come under this heading are divided into following two subheadings :

(A) Current assets

(B) Loans and advances.

(A) Current assets:

The items included in this subheading are as under:

- Accrued interest on investment

- Stores and spare parts

- Loose tools

- Stock in trade

- Work-in-progress

- Sundry Debtors:

- Debts outstanding for more than six months

- Other debts Less : Provision for doubtful debts,

- Cash and bank balance. In case of debtors, their particulars should also be given regarding their quality

- such as; (i) Debts fully secured

- Debts secured on personal security and

- Debts considered doubtful or bad.

Question 4.

Differentiate between reserves and provisions.

Answer:

The various differences between reserves and provisions are as follows:

Question 5.

Write a short note on:

- Preliminary expenses

- Unclaimed dividend.

Answer:

1. Preliminary expenses:

While commencing a company, apart from the value of assets, other expenses which are incurred are called preliminary expenses. It includes expenses in acquisition of buildings, printing expenses of various documents, commission given for the transaction of assets, brokerage and other sundry expenses.

2. Unclaimed dividend:

That amount of declared dividend, where no claim has been made so far, is called unclaimed dividend. It should be paid within a year.

Question 6.

Rearrange the following items under three heads :

- Fixed Assets

- Current Assets

- Loans and Advances.

Livestock, leasehold land, Cash in hand, Loose tools, Trademark, Work-in progress, Goodwill, Stores and spare parts, Plant, Trademark, Furniture, Interest accrued, Bills receivables, Vehicles, Bank balance, Debtors, Loans to subsidiaries, Land.

Solution:

Question 7.

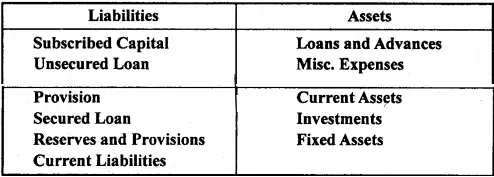

Show how the assets and liabilities are arranged properly according to Section VI, Part-I of Companies Act of 1956 from the following information

Answer:

Question 8.

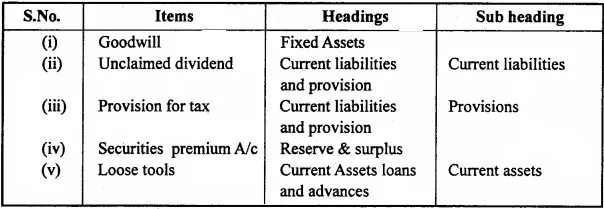

Under what headings the following items are shown in the Balance sheet of the company:

- Goodwill

- Unclaimed dividend

- Provision for tax

- Securities premium A/c

- Loose tools.

Solution:

Balance Sheet of Company:

Question 9.

Under what headings will you show following items in balance sheet:

- Goodwill

- Bill receivable

- Capital reserve

- Sundry creditors

- Building

- Sundry Debtors

- Debentures

- Issued capital.

Answer:

- Goodwill — Fixed assets.

- Bills receivable — Current assets

- Capital Reserve — Reserves and provisions

- Issued capital — Share capital

- Sundry creditors — Current liabilities

- Building — Fixed assets

- Sundry Debtors — Current assets

- Debentures — Secured loan.

Financial Statements of a Company Long Answer Type Questions

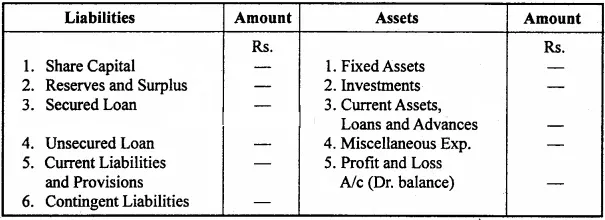

Question 1.

What are the main items of liability side of balance sheet of a company ?

Answer:

Main Items of Balance Sheet and their Details: The main items of balance sheet as mentioned in the part I of the schedule VI of the Indian Companies Act 1956 is as under:

Main items of liability side:

In the balance sheet, the items of liabilities are mentioned under the following heads:

1. Share capital:

The share capital should be classified into following categories:

(i) Authorized capital:

This is the maximum amount of capital which a company can collect by way of issuing of shares. Under this heading the number and the nominal value of shares is given. This amount of capital is not included in the total of the liability side since only a part of the authorized capital is issued for subscription.

(ii) Issued capital:

It is that part of the authorized capital which has actually been issued to the public for subscription so far. It mentions each category of capital, i.e., equity or preference shares which has been issued. Issued capital can never be greater than the authorized capital.

(iii) Subscribed capital:

Subscribed capital is that part of issued capital for which the applications have been received from the public. Subscribed capital is also not included in the total of the liability side. To keep it separate from the total, double close lines are drawn below this amount.

(iv) Called-up capital: It is that part of subscribed capital which has actually been called from the public. The called-up capital can never exceeds the subscribed capital.

(v) Paid-up capital: It is that part of called-up capital which has actually been paid by the public in response to the calls made by the company.

2. Reserve and surplu:

Reserves are the part of profit which is accumulated out of undistributed profits. The reserves and surplus should be categorically mentioned in the balance sheet as:

- Capital Reserve

- Capital Redemption Reserve

- Share Premium Account

- Other specific reserves

- Proposed additions to reserves

- Sinking fund.

After making other necessary appropriations the balance of profit and loss account is also shown under this head.

In case of each of the above reserves, the additions and deductions made since last balance sheet must be disclosed clearly. The debit balance (if any) of the profit and loss account must be shown as deducted from unspecific free revenue reserve. The surplus of profit and loss account (after appropriation) should also be shown under this head.

3. Secured loans:

Loan obtained against pledge of assets as security or against guarantee of repayment made by the company is called secured loan. It includes debentures as per their condition of repayment, bank loans, loans and advances from subsidiary companies, other loans advances, etc. All secured loans must be shown under proper subheadings. Interest accrued and due on unsecured loans are to be included under the appropriate subheadings.

In addition to it the terms of redemption or conversion of loans should also be mentioned along with the earliest date of Redemption or conversion. Under this heading the loan taken from the directors, managing directors / agents, secretaries, etc. should be shown separately. Against each item of loan the security offered should be specified in the balance sheet.

4. Unsecured loan:

When a company borrows loan without giving any security, such loans are known as unsecured loans. The items included under this heading are; Fixed deposits, loans and advances from subsidiary companies, short-term loans and advances from banks or from others. Other loans and advances from banks. Here, by short-term loan we mean such loans which are due for repayment within a period of one year from the date of the balance sheet.

Unsecured loans from directors, managers, managing directors, secretary, treasures and managers should be shown separately. Interest due, but not paid on unsecured loans should be shown along with the concerned loan amount.

5. Current liabilities and provisions:

This item is divided into two main parts namely:

(i) Current liabilities:

All such liabilities which are payable within a period of one year are included under this heading. The items included in it are; bills payable, sundry creditors, advance income, outstanding expenses, unclaimed dividends, interest accrued but not due on loans, etc.

(ii) Provisions:

It is a charge against profit to meet certain known liability for which the exact burden cannot be ascertained with substantial accuracy. In case, such provision exceeds the actual liability the excess is treated as reserve. Provision is maintained even in the years of loss, since it is a charge against the profit.

Under this head the items like provision for taxation, proposed dividend, provision for contingencies, for P.F. of the employees, for other staff benefit schemes such as employees insurance and pension, etc. are included in it.

Question 2.

Explain the items which are shown on the asset side of balance sheet under the main heads of public limited company.

Answer:

The following items are included on the asset side of the balance sheet of a public limited company under the main heads:

1. Fixed assets:

Under this heading, fixed assets of the company are shown in their cost price. Appreciation or depreciation are added or deducted.

2. Investments:

To earn income securities are purchased for business purpose. They are shown under this heading.

3. Current assets, loans and advances:

This heading is also divided into two subheads:

(i) Current assets:

It means such assets which can be changed into cash within the year or immediately. Stock of goods, sundry debtors, etc. are entered in this head.

(ii) Loans and advances:

Under this heading, it is entered bills receivable, loans and advances from subsidiary companies etc. are shown.

4. Miscellaneous expenditure:

Under this heading, preliminary expenses, commission and brokerage on shares and debentures etc. are shown.

5. Profit and loss account:

When there is a debit balance of profit and loss A/c, it is shown under this heading.

Question 3.

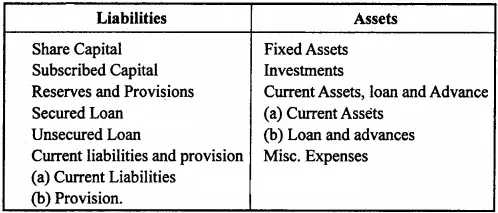

Write the names of accounts which are shown on the assets side and liabilities side of balance sheet of a company under main heads in the horizontal form.

Or

Write some important items (only main headings) showed as Indian company’s Act 1956 schedule VI-I in balance sheet.

Answer:

Under the ahead heads, the items are shown on the assets and liabilities side of a company balance sheet:

Balance Sheet of a Ltd. Company:

Question 4.

Write some elements of sound or good financial statement

Or

Write the characteristic of an ideal financial statement.

Answer:

Elements of sound financial statement are as follows:

- Simplicity : It should be simple and easy to understand. The size of this kind of financial statement not so big.

- Accuracy: It should be accurate whatever the conclusion drawn from it are accusable and effective.

- Understandable: It should be easy to understand. Any body can understand.

- Easy: It should be easy to calculate. An average person can understand and able to calculate it.

Question 5.

Write short notes on following:

(A) Current liabilities and provisions

(B) Current assets, loans and advances.

Answer:

(A) Current Liabilities and Provisions: There are two parts under this head:

(a) Current Liabilities:

These are those liabilities which are repayable within one year. Current liabilities include bills payable, sundry creditors, advance payments, unclaimed dividends, etc. These are shown in part A.

(b) Provisions:

‘Provisions’ are shown in part B and they include provision for taxation, proposed dividend, provident fund, provision for insurance and pension schemes etc.

(B) Current Assets, Loans and Advances:

These are the assets which are likely to be converted into cash within a year from the date of the balance sheet. These are divided into two parts:

(a) Current Assets:

These include, (i) Interest accrued on investments, stores and spare parts, loose tools, stock-in-trade, works-in-progress, sundry debtors (Debts out standing for more than 6 months; other debts), cash and bank balance.

(b) Loans and Advances:

Cash loans given to different persons, advances against purchase of goods and various expenses by the company etc., are included in it. These items should be shown in the balance sheet under separate subheadings:

- Advances and Loans to Subsidiaries,

- Bills of exchange,

- Advances recoverable in cash or in kind for value to be received eg., Rates, Taxes, Insurance etc.

- Balance with customs, port trust etc.

Question 6.

Explain in details, the importance of financial statements.

Answer:

Following are the importance of financial statements for various parties:

1. Management:

The management uses accounting information to take various decision. The management has the responsibility to protect die owner’s investment and to increase its value by managing the business efficiently so that it earns maximum profit.

2. Investors:

The investor includes both long term and short term investors. The main purpose of these investors is to protect the appropriate money and earn enough income on it. For this they need much information about the company’s economic status, profit earing capacity, current value of shares.

3. Bank and other lending institutions:

As bank and financial institutions provide loan to the business they are interested in knowing the performance of the business to know whether it is making progress as projected to ensure the safety and recovery of the advanced I loan.

4. Employees and trade unions:

The employees and trade union gets financial status and financial information from these statements. The various facilities and employee’s demand depend on the financial condition of the business enter prize. Earning capacity are affected by wages, allowances, bonus etc.

5. Government and government agencies:

The government came to know about the economic development of the country from the financial statements. The government agencies studies the security of the interest of the shareholders. The government calculate the national income from the information collected through these statement and also ensures that the legal provisions in the articles are being followed or not.

Question 7.

Explain the limitations of financial statements.

Answer:

The limitation of financial statements are as follows:

1. Do not reflect current situation:

Financial statements are prepared on the basis of historical cost. Since the purchasing power of money is changing, the value of assets and liabilities shown in financial statements do not reflect current market situation.

2. Assets may not realize:

Accounting is done on the basis of certain conventions. Some of the assets may not realise the state value if liquidation is forced on the company. Assets shown in the balance sheet reflect only unexpired cost.

3. Bias:

Financial statements are the outcomes of the recorded facts, accounting concepts and convention used and personal judgement made in different situations by the Accountants. Hence, bias may be observed in the results and the financial position depicted in financial statements may not be realistic.

4. Aggregate information:

Financial statements show aggregate information but not detailed information. Hence they may not help the users in decision making sufficiently.

5. Vital information missing:

Balance sheet does not disclose information relating to loss of markets and cease of agreements which have an important impact on the enter prize.

6. No qualitative information:

Financial statements contain only monetary information but not qualitative information like industrial relations, industrial climate, labor relation, quality of work etc.

Question 8.

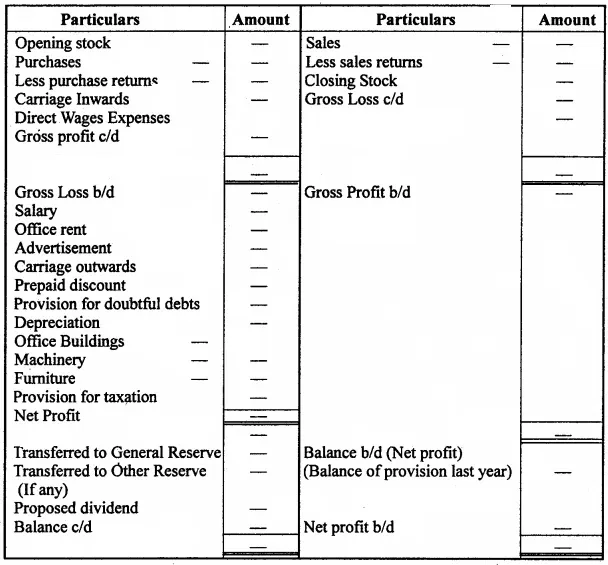

Draw the specimen of income statement and explain its elements.

Answer:

Profit and Loss A/c

For the year ending on of company Ltd.

Final Words

So friends, how did you like our post! Don't forget to share it with your friends below the sharing button post. Apart from this, if there is any problem in the middle then do not hesitate to ask in the comment box. We will be happy to assist you. We will keep writing more posts related to this. So don't forget to bookmark (Ctrl+D) our blog “various info: Education and Tech” on your mobile or computer and subscribe us now to get all the posts in your email.

If you liked this post then don't forget to share it with your friends. You can help us reach more people by sharing it on social networking sites like WhatsApp, Facebook or Twitter. Thanks!

If you liked the information of this article, then please share your experience by commenting. This is very helpful for us and other readers. Thank you