Students who are planning to learn and understand the topics of MP Board Class 12th Accountancy Important Questions Chapter 11 Cash Flow Statement for free from this page. Make sure you use them as reference material at the time of preparation and as a good grade in the final exam. Students who find it difficult to learn English concepts can take the help of this MP Board Class 12th Accountancy Important Questions Chapter 11 Cash Flow Statement PDF and answer all questions in the exam easily. Go through the below sections and get the MP Board Class 12th Accountancy Important Questions Chapter 11 PDF. Students can also download MP Board 12th Model Papers so that you can revise the entire syllabus and get more marks in your exams.

Table of content (TOC)

MP Board Class 12th Accountancy Important Questions Chapter 11 Cash Flow Statement

Cash Flow Statement Important Questions

Cash Flow Statement Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Cash flow analysis means:

(a) To disclose the changes in the amount of cash in an organization

(b) To find out embezzlement of cash

(c) To trade in cash

(d) None of these.

Answer:

(a) To disclose the changes in the amount of cash in an organization

Question 2.

Cash received from operating activities refers to:

(a) Cash flow during a specific period

(b) Cash resulting out of business activities during a specific period

(c) Deposit of cash in the bank

(d) None of these.

Answer:

(b) Cash resulting out of business activities during a specific period

Question 3.

In flow of cash in cash flow statement means:

(a) Transactions that result in the increase of sources of cash and cash balance

(b) Transactions that result in the decrease of sources of cash inflow

(c) Transactions which have no effect on the sources of cash inflow

(d) Transactions that results in increase of fixed assets.

Answer:

(a) Transactions that result in the increase of sources of cash and cash balance

Question 4.

In how many ways is the cash flow statement prepared:

(a) One

(b) Two

(c) Four

(d) None of these.

Answer:

(b) Two

Question 5.

It is compulsory to prepare and present cash flow statement for:

(a) Pvt. company

(b) All listed company

(c) Public Ltd company

(d) Foreign company.

Answer:

(b) All listed company

Question 6.

Cash flow statement is prepared by:

(a) All company

(b) Every commercial organization

(c) Every partnership firm

(d) Every co-operative organization.

Answer:

(a) All company

Question 2.

Fill in the blanks:

- The statement which is prepared to know the difference between current assets and current liabilities is known as …………….

- The statement in which changes in inflow (receipts) and outflow (payments) of cash are known is called …………….

- The situation in which there is decrease in cash balance of business is called …………….

- In the condition of ……………. the balance of cash increases in business.

- Cash flow statement is prepared in ……………. steps.

- If the net profit earned during the year is Rs. 50,000. The initial and final account holders of Debtors are Rs. 10,000 and Rs. 20,000 respectively. Then the cash flow will be equal to ……………. from operarting activities.

- At the end of the year prepaid expenses ares ……………. from the earned profit for the

year. - The accured income of a year is ……………. from the net profit.

- For the calculation of cash flow from operating activities, writing off the goodwill is ……………. during the year.

- For the calculation of cash flow from operating activities, the provision for bad debts are ……………. to the earned profit the year.

- Creditors are the ……………. of a company.

- Realization of loan is included in ……………. activities.

- Cash flow statement depict the ……………. changes between cash & cash equivalents.

- Redemption of preference share is known as ……………. activities.

- In a commercial organization, the operating activities are its ……………. activities.

Answer:

- Fund flow situation

- Cash flow statement

- Out flow of cash

- Inflow of cash

- Three

- Rs. 40,000

- Deducted

- Added

- Added

- Added

- Liabilities

- Financial

- Historical

- Financial

- Main / Chief.

Question 3.

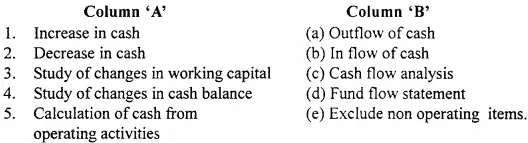

Match the columns:

Answer:

- (b) In flow of cash

- (a) Outflow of cash

- (d) Fund flow statement

- (c) Cash flow analysis

- (e) Exclude non operating items

Question 4.

Write true or false:

- Profit earned during the accounting year is called net profit.

- Cash flow analysis does not provide information regarding the direction and condition of changes in cash.

- The position of working capital of business can be known through cash flow statement.

- Cash received from operating activities is the result of cash generated through business activities.

- In single column cash flow statement, inflow of cash is added.

Answer:

- True

- False

- False

- True

- True.

Question 5.

Write the answer in one word / sentence:

- A statement which shows the financial condition through inflow and outflow of funds.

- Statement showing changes in cash positions.

- Cash resulting out of business activities is called as

- Issue of shares and debentures in consideration other than cash and assets shown in the cash flow statement against issue of shares and debentures are called

- Which statement is related to each item of working capital.

Answer:

- Fund flow statement

- Cash flow statement

- Cash from operation

- Non current assets

- Fund flow statement.

Cash Flow Statement Very Short Answer Type Questions

Question 1.

What do you mean by cash flow statement ?

Answer:

Cash flow statement means statement of change in cash position of the enterprise. It analyses the causes of changes in cash position between the two financial statements. It is a statement which shows inflows and outflows of cash and cash equivalents in an enterprise during a specified period of time. This statement is the summary of sources of cash and application of cash in various fields.

Question 2.

What is the meaning of flow in cash flow statement ?

Answer:

In the cash flow statement, there is a combination of two words ‘Cash’ and ‘Flow’. The meaning of the word ‘Cash’ is cash balance and bank balance. The word ‘Flow’ refers to the change or movement. In this way ‘cash flow statement’ (CFS) means the changes occurred during any period in the cash position business or institution which exhibits the cause and amount of changes and direction.

In this statement he sources of cash, uses of cash and net cash position is included, which is the difference of total sources and uses. This statement is also known by the name statement of sources and uses of cash of statement of sources and application of cash.

Flow of cash:

Cash Flow is created when the net effect of any transaction either bring increase or decrease in the cash amount. That transaction which apart from cash account, affects other current accounts or non-current accounts or both, it creates change in cash position.

Through those transactions by which there is an increase in the cash balances of the business or inflow of cash or by those transactions, there from comes decrease in cash balance of business, they are presumed to be the uses of cash or outflow of cash. In other words, the receipt of cash can be called flow of cash and payment can be called as the use of cash.

Question 3.

Write the major source of cash.

Answer:

The major source of cash are as under:

- Issue of equity and preference shares for cash

- Raising of long term debts – issue of debentures for cash, accepting deposits from public

- Sale of fixed assets in cash

- Non-operating incomes-Dividends and interest on investment

- Cash from operating activities of the business.

Question 4.

Write any four utilities of cash flow statement.

Answer:

Utilities of cash flow statement are as follows:

- Evaluation of cash position

- Enable management in planning and control.

- Disclose failure or success of management by performance evaluation

- Helps in framing long term planning

- Helps in determining cash flows from different activities separately.

- Evaluation of liquidity position of the firm.

Question 5.

What is meant by ‘Cash flow from operating activities’ ?

Answer:

As per AS – 3, operating activities are the principal revenue producing activities of the enterprise, e.g., for a company dealing in manufacturing of garments, purchase of raw materials, payment of manufacturing expenses, sale of garments etc. are the principal revenue producing activities. Cash inflows and outflows from these activities will affect the calculation of profits or loss of the business.

Question 6.

Mention the four objects / importance of cash flow statement.

Or

What are the uses of cash flow statement ?

Answer:

The followings are the objectives of cash flow statement:

- This is useful in the evaluation of cash of the institution. By this, through budget, the need of the cash of the institution can be estimated,

- The use of cash can be controlled according to plan

- This analysis is also helpful in the evaluation of financial policies.

- By cash flow analysis, the knowledge of redemption capacity of the institution is also possible.

Question 7.

Differentiate between net profit and cash received from operation

Answer:

The differences between net profit and cash from operation:

Question 8.

Write the limitations of cash flow statement.

Answer:

The limitations of cash flow statement are as follows:

1. Non – cash transactions are ignored:

Cash flow statement shows only inflows and outflows of cash and cash equivalent. It ignores non-cash transactions like conversion of shares into debentures, purchase of building by issue of shares.

2. Lack of Accuracy:

Cash flow statement is prepared on the basis of financial statement. So if financial statement is incorrect, the cash flow statement may be incorrect.

3. Long-term analysis not possible:

Through cash flow statement long-term analysis is not possible. It ascertain only the short-term financial position of the business.

Question 9.

When does investment is equivalent to cash ?

Answer:

There are two stages are as follows:

- When invest is for short-period of time like 3 months or less than 3 months

- When invest can converted into cash without any risk

- When goods purchased for issuing shares.

Question 10.

Explain operating activities.

Answer:

Operating activities are the main revenue producing activities of the enterprise. This activities comprises of all those transaction and events which determine net profit or loss of the business. Example of cash receipt from operating activities are cash received on sale of goods and rendering of services, cash receipt from royalties, fees, commission etc., cash receipt from sale of securities.

Question 11.

Explain any four objectives of cash flow statements.

Answer:

Objectives of cash flow statements are:

1. Analysis of cash position:

Cash flow statement explains the reason for lower or higher cash balance with the firm. Sometimes a firm may have lower cash balance in spite of higher profits or a higher cash balance in spite of lower net profits. Cash flow statement does help in explaining the causes of such quotation.

2. Short term cash planning and management:

Cash flow statement is very useful for short term financial planning and management. This statement reveals the position of surplus or deficiency of cash so that the management may be able to make plan for proper investment of surplus cash or to tap the sources where from the deficiency is to be met with.

3. Evaluation of liquidity:

Liquidity means ability to meet current obligations at due time i.e., payment to creditors, repayment of bank loan etc. Cash flow statement disclose the position of liquidity in a better way and that is why banks and other financial institutions use cash flow statements for the evaluation of liquidity of any firm.

4. Comparison of operating performance:

Cash flow statement enhances the comparability of the reporting of operating performance by different enterprises because it eliminates the effects of using different accounting treatment of the same transactions and events.

Question 12.

Give any two methods of financial statement analysis.

Answer:

The two methods of financial statement analysis are as follows :

- Comparative statement

- Common size statement.

1. Comparative statement:

Comparative financial statements refer to those statement which exhibit the financial position of a business concern at different periods of times. The statements are prepared in comparative form in this comparatively side by side so as draw conclusion about the profit earning capacity of firm.

2. Common size statement:

Common size statement refer to those statement in which figures reported are converted into percentage to some common base like net sales for income statement and total assets for Balance sheet. In this statement net sales assumed as 100 and other figures are expressed as percentage on net sales.

Question 13.

Write the name of any four sources of cash receipts in a business.

Answer:

Sources for Procuring cash are as follows:

- Sale of fixed assets

- Interest on investment

- Increase in share capital

- Issue of shares and debentures

- Dividend received.

Question 14.

By which method cash flow by operating activities can be calculated ?

Answer:

As per accounting standard-3 operating activities are the principal revenue generating activities of the business. All such activities are included in operating activities of the business which are not related to investment and financial activities and generate income. Cash flow from the operating activities indicates that there is sufficient cash generation which helps the business in its smooth operation.

The cash inflow includes cash receipts from sale of goods and services, cash receipts from royalties, fees, commission etc. and cash outflow includes cash payment for purchases of goods and services, cash payments for wages, salaries and other payments to employee, cash payment of taxes etc.

Question 15.

What do you mean by financial activities ?

Answer:

Financing activities are those activities which relates to long term funds or capital of an enterprise, cash received from issue of equity shares, debentures, raising loan (long term) etc.

Question 16.

What do you mean by non-cash transactions ?

Answer:

The transactions which do not part of Financing or Investing activities are called non-cash items or transaction. For Example : Depreciation, conversion of debenture into shares.

Cash Flow Statement Short Answer Type Questions

Question 1.

Write difference between fund flow statement and cash flow statement.

Answer:

The differences between fund flow statement and cash flow statement are:

Question 2.

What are the uses of cash flow statement ?

Answer:

The uses of cash flow statement may be studied under following:

1. Analysis of cash position:

Cash flow statement explains the reason for lower or higher cash balances. Since it is prepared on cash basis of accounting, it proves very useful for the evaluation of cash position of a business enterprise.

2. Assessment of liquidity:

Liquidity means ability to meet current obligations on due time, i. e., payment to creditors, repayment of bank loan etc. It can be assessed with the help of cash flow statement.

3. Tool of short-term financial planning:

Cash flow statement is helpful in planning short-term need of cash of the enterprise. This statement reveals the position of surplus or deficiency of cash. It is the most appropriate device for short-term analysis.

4. Helpful in estimating future cash flow:

Historical cash flow information provides useful indicators of the amount, timing and certainty of future cash flows. It is also useful in checking the accuracy of parts assessments of future cash flows.

5. Helpful in the formation of policies:

Cash flow statement help in formation of various policies such as repayment of long-term loans, expansion or replacement of fixed assets declaration of dividend etc. which can be successfully implemented with sufficient cash resources.

6. Knowledge of progress of business:

Cash flow statement determine the inflow and outflow of cash from operating activities which show the progress of the enterprise or otherwise.

7. Useful to external analysis:

It is also useful to external analysis particularly to the bankers investors and creditors because they review the financial position of the concern and such review is greatly facilitated by cash flow statement.

Question 3.

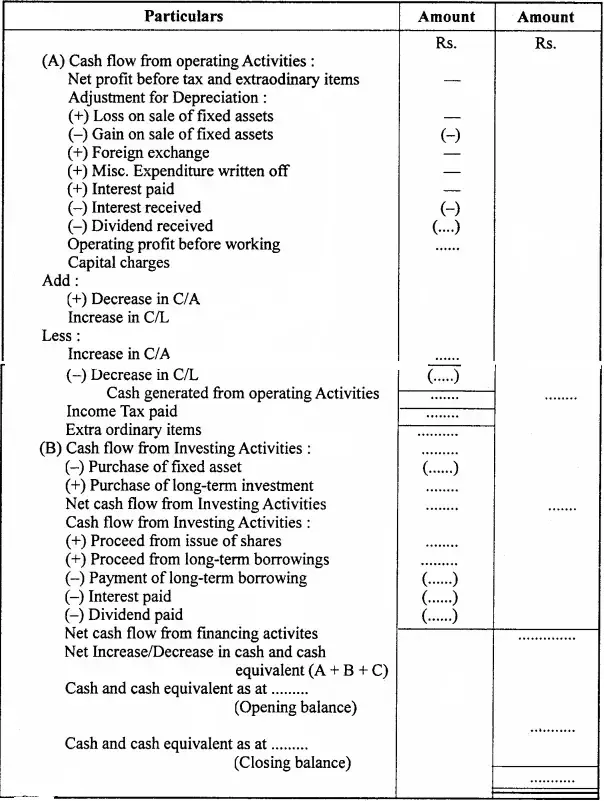

Give the format of cash flow statement

Answer:

Format of cash flow statement: Indirect method:

Question 4.

Describe the importance of fund flow statement.

Or

Explain any four objectives of fund flow statement.

Answer:

The objectives of preparing a fund flow statement are as follows:

(1) Helpful in financial analysis:

Financial analysis is facilitated by fund flow statement. The balance sheet do show the financial position but changes in various assets and liabilities is not shown by the balance sheet. The fund flow statement provides information as regard to the changes in various items of assets and liabilities.

(2) Determination of fund from operation:

Fund flow statement provides the information of actual profit earned through operational activities. Fund flow statement determines the fund from operational not activities by re-adjusting those non-trading income, expenses and losses.

(3) Management of working capital:

In fund item statement the word ‘fund’ refers to working capital. Through fund flow statement it can be determined whether there is sufficient amount of working capital within the business or not.

(4) Knowledge of sources and use of fund:

An analysis of various searess of receipt and application of fund can be made through fund flow statement. From the statement the business can determine the various sources and the receipt of as well as sources and quantum of payment.

(5) Knowledge of some important funds:

The fund flow statement provide various significant information to the managers owners and other related parties. These information are:

- Major heads of income and expenses during a period.

- Determination of total fund received from various sources.

- Application of amount on various items.

- How the profit has been used

- Dependency of firms on borrowings.

- Burden of cost of capital etc.

Question 5.

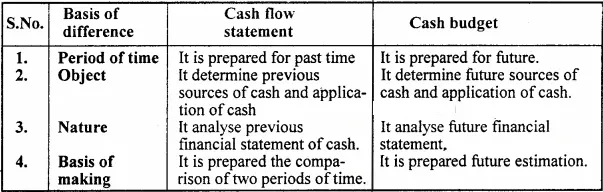

State some differences between cash flow statement and cash budget.

Answer:

The differences between cash flow statement and cash budget:

Final Words

So friends, how did you like our post! Don't forget to share it with your friends below the sharing button post. Apart from this, if there is any problem in the middle then do not hesitate to ask in the comment box. We will be happy to assist you. We will keep writing more posts related to this. So don't forget to bookmark (Ctrl+D) our blog “various info: Education and Tech” on your mobile or computer and subscribe us now to get all the posts in your email.

If you liked this post then don't forget to share it with your friends. You can help us reach more people by sharing it on social networking sites like WhatsApp, Facebook or Twitter. Thanks!

If you liked the information of this article, then please share your experience by commenting. This is very helpful for us and other readers. Thank you