Students who are planning to learn and understand the topics of MP Board Class 12th Accountancy Important Questions Chapter 10 Analysis of Accounting Ratios for free from this page. Make sure you use them as reference material at the time of preparation and as a good grade in the final exam. Students who find it difficult to learn English concepts can take the help of this MP Board Class 12th Accountancy Important Questions Chapter 10 Analysisof Accounting Ratios PDF and answer all questions in the exam easily. Go through the below sections and get the MP Board Class 12th Accountancy Important Questions Chapter 10 PDF. Students can also download MP Board 12th Model Papers so that you can revise the entire syllabus and get more marks in your exams.

Table of content (TOC)

MP Board Class 12th Accountancy Important Questions Chapter 10 Analysis of Accounting Ratios

Analysis of Accounting Ratios Important Questions

Analysis of Accounting Ratios Objective Type Questions

Question 1.

Choose the correct answer:

Question 1.

Ratio analysis means:

(a) To establish mathematical relation between two figures

(b) To establish qualitative relation between two figures

(c) To establish inverse relation between two figures

(d) None of these.

Answer:

(a) To establish mathematical relation between two figures

Question 2.

Current ratio represents:

(a) Surplus of fixed assets over fixed liabilities

(b) Surplus of current assets over current liabilities

(c) Surplus of artificial assets over current liabilities

(d) Surplus of assets over liabilities.

Answer:

(b) Surplus of current assets over current liabilities

Question 3.

Liquid assets refers to:

(a) The assets which can be converted into cash immediately

(b) The assets which cannot be converted into cash immediately

(c) The assets which can be sold at profit

(d) The assets which can be sold at cost price.

Answer:

(a) The assets which can be converted into cash immediately

Question 4.

Meaning of solvency ratio is:

(a) Capability of paying internal debts

(b) Capability of paying external debts

(c) Capability of acquiring assets

(d) None of these.

Answer:

(b) Capability of paying external debts

Question 5.

Capital turnover ratio establishes relationship between:

(a) Sales and purchase

(b) Net sales and capital employed

(c) Gross sales and capital employed

(d) None of these.

Answer:

(b) Net sales and capital employed

Question 6.

The given below classes of ratio mainly calculate the risks:

(a) Liquidity, Activity and Profitability

(b) Liquidity, Activity and Stock

(c) Liquidity, Activity and Solvency

(d) Liquidity, Solvency and Profitability.

Answer:

(d) Liquidity* Solvency and Profitability.

Question 7.

The ……………. ratio calculates the main and suffix gains:

(a) Liquidity

(b) Activity

(c) Solvency

(d) Profitability.

Answer:

(d) Profitability.

Question 8.

In a commercial firm calculation of …………… is done on the basis of its paying capacities of short term liabilities:

(a) Activeness

(b) Liquidity

(c) Debts

(d) Profitability.

Answer:

(b) Liquidity

Question 9.

………….. ratios are an indicator of the intensity of change in proceeds or cash coming from the practice of diverse account:

(a) Activity

(b) Liquidity

(c) Solvency

(d) Profitability.

Answer:

(a) Activity

Question 2.

Fill in the blanks:

- Liquidity refers to the ability of concerting assets into …………………

- The capability of paying external debt is found out through …………………

- Current ratio is also called as ………………… ratio.

- Gross profit ratio is calculated on ………………… sales.

- ………………… ratio can be found out by dividing cost of goods sold by average stock.

Answer:

- Cash

- Solvency ratio

- Working capital

- Net sales

- Stock turnover ratio.

Question 3.

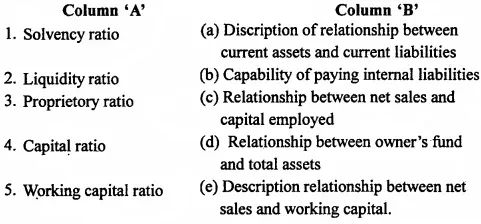

Match the columns:

Answer:

- (b) Capability of paying internal liabilities

- (a) Description of relationship between current assets and current liabilities

- (d) Relationship between owner’s fund and total assets

- (c) Relationship between net sales and capital employed

- (e) Description relationship between net sales and working capital.

Question 4.

Write true or false:

- Liquidity ratio refers to the ability of converting assets into cash.

- Solvency ratio refers to the ability of paying internal debts.

- Working capital is related to current assets and current liabilities.

- Debtor’s turnover ratio does not show relationship between net credit sales and average trade debtors.

- The main purpose of financial reporting is to inform the directors of the organization about the progress of its functionality.

- Analysis of the data provided in the financial statement is known as financial Analysis.

- Long term loan of the firm had a deep concern on the Interest and principal sum paying capacity of the firm.

- A ratio is always expressed as the product of the division of a second number by a number.

- A ratio shows both quantitative and qualitative aspects.

Answer:

- True

- False

- True

- False

- False

- True

- True

- False

- False.

Question 5.

Write the answer in one word/sentence:

- The assets which can be converted into cash immediately.

- Surplus of current assets over current liabilities.

- The ratio which is used to calculate relationship between net sales and capital employed.

- Which ratio is related to paying of external debts.

- Which ratio is related to cost of goods sold and average stock.

Answer:

- Liquid assets

- Working capital

- Capital ratio

- Solvency ratio

- Stock turnover ratio.

Analysis of Accounting Ratios Short Answer Type Questions

Question 1.

Explain liquidity ratio.

Answer:

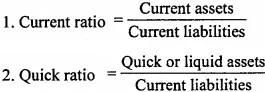

Liquidity means the ability of an enterprise to meet its current liabilities out of current assets. Liquidity ratios are computed to find out the short-term solvency of the enterprise short-term creditors and managers / directors are interested to know liquidity 1 position of the enterprise. These ratios disclose the sufficiency of working capital. Liquid it is the case where assets may be converted into cash without loss. The following ratios are calculated for liquidity test:

- Current ratio or working capital ratio

- Liquid ratio or quick ratio

Question 2.

Write differences between current ratio and quick ratio.

Answer:

The difference between current ratio and quick ratio:

Question 3.

What is solvency ratio ?

Answer:

Solvency means the ability of an enterprise to meet its long-term obligations and thus solvency ratios reveals an enterprises ability to meet the long-term indebtness. Principally an enterprise should have sufficient funds to meet the long-term liabilities main solvency ratio are:

- Debt equity ratio

- Total assets to debt ratio

- Proprietary ratio.

Question 4.

What is activity ratio ?

Answer:

Activity ratios are concerned with measuring the efficiency in assets management. It is concerned with employment of assets efficiently and in a profitable way. These ratios are calculated on the basis of sales or cost of goods sold, various assets like stock debtors, bills receivable, fixed assets etc and investments of the concern. These ratios are also known as turnover ratio or performance ratios. Following are important activity ratios:

- Stock turnover ratio

- Debtors turnover ratio

- Creditors turnover ratio

- Net working capital ratio

- Fixed assets turnover ratio

- Current assets turnover ratio

- Capital turnover ratio.

Question 5.

What is profitability ratio ?

Answer:

Profitability means possibility of earning profit on the fund invested in the business. Profitability of a business can be determined on the basis of sales or investment. Usually it is determined on the basis of safes. The condition of profitability of a business concern depend on the sales volume, costing methods and proper use of various financial resources. Hence calculation of the ratio relating to sales, investments and funds of equity shareholders is called profitability ratio. Some important ratios are as given below:

- Gross profit ratio

- Operating ratio

- Net profit ratio

- Return on investments

- Earning per share

- Dividend per share

- Price earning ratio.

Question 6.

What do you mean by current asset in current ratio ?

Answer:

Current ratio establishes relationship between movable assets and movable liabilities. Current ratio includes cash-in-hand, bank, debtors, receivable bills and other properties in current assets.

Question 7.

What is current ratio ? How is it calculated?

Answer:

Current ratio is used to measure the efficiency of the firm to pay off its short-term liabilities. This ratio establishes the relationship between current assets and current liabilities. This ratio shows whether the current assets of the firm are adequate to meet out its current liabilities or not. This ratio can be calculated by using this following formula:

Question 8.

Which items are included in current liabilities ? (any four)

Answer:

Following items are usually included in current liabilities:

- Creditors

- Bills payable

- Outstanding expenses

- Bank loan

- Bank overdraft

- Unearned income

- Provision for taxation.

Analysis of Accounting Ratios Long Answer Type Questions

Question 1.

Explain the importance of ratio analysis.

Or

Write two objectives of ratio analysis.

Answer:

me importance of ratio analysis for different interest groups is as below:

1. For short-term creditors:

Liquidity ratio i.e., current ratio and quick ratio are computed to find out the short-term solvency of the enterprise. Short-term creditors are interested in liquidity position of the concern. It helps to assess the ability of enterprise to meet its short-term liabilities promptly.

2. For long-term creditors:

Accounting ratios i. e„ solvency ratio discloses an enterprises ability to meet the long-term in debtedness with the help of debt equity ratio and interest ratio, solvency of enterprise can be assessed easily.

3. For managers:

Management takes many decisions in respect of business. Information regarding availability of working capital, compassion with other business unit etc. are received with the help of ratio analysis. With the help of ratio analysis the administrative work can be controlled easily.

4. For investors:

Ratio analysis proves helpful to know the short-term and long-term financial position of a business undertaking which helps investors for investing their money with the expectation of a good return. It enables the investors to study the result of various ratios and to tops proper decision.

Question 2.

Explain the meaning and purpose of the following ratio:

- Current ratio

- Debt equity ratio

- Proprietary ratio

- Capital turnover ratio

- Fixed assets turnover ratio

- Working capital turnover ratio.

Answer:

Meaning and objective or purpose of the ratios are as follows:

1. Current ratio:

Current ratio refers to the relationship between current assets and current liabilities. It measures the firm’s ability to full fill short-term commitment out of its current assets.

Objective:

The objective of current ratio is to assets the ability of enterprise to meet its short-term liabilities promptly.

2. Debt equity ratio:

This ratio expresses a relationship between debt and the equity. Debt means long-term loans, debentures and equity means shareholder’s fund, preference share capital, equity share capital, reserves less losses and fictitious asset like preliminary expenditure.

Objective:

This ratio judges the long-term financial position and soundness of the enterprise. It indicates the proportion between shareholders fund and long – term debts.

3. Proprietary ratio:

This ratio expresses the relationship between the total amount of owner’s funds and total assets. It shows the extent to which the shareholders own the business.

Objective:

Proprietary ratio expresses the general financial position of the enter-prise. It indicates what percentage of total asset has been financed by the shareholders fund.

4. Capital turnover ratio:

This ratio shows the efficiency of capital employed in the enterprise by how many times it is used to produce the sales. It establishes the relationship between sales and cost of sales and capital employed.

Objective:

Capital turnover ratio indicates the efficiency of capital employed in the enterprise by computing how many times the capital being turned overed.

5. Fixed assets turnover ratio:

The relationship between cost of sales or sales and fixed assets is known as fixed assets turnover ratio.

Objective:

This ratio, indicates how efficiently the fixed assets were used in business.

6. Working capital turnover ratio:

Working capital turnover ratio expresses the relationship between working capital and sales. It shows whether or not the working capital is utilized to increase sales.

Objective:

The objective of the ratio in to assertion whether or not working capital has been effectively utilized in promoting sales

Question 3.

What is average collection period?

Answer:

Debtor turnover ratio is related to average collection period which shows that in how many days the firm is realising its debts from debtors. It also highlights upon the quality of the debtors. The lower the .collection period the good the debtors are which is indicative of the fact that debtors are being realized soon. If this period is high, then it indicates that the fing liberal policy of collection realisation from debtors takes lot of time.

Question 4.

Discuss four limitations of Accounting ratios.

Answer:

limitations of Accounting ratios are:

1. Only quantitative analysis and not qualitative:

Under this, attention is not paid on the qualitative reasons. For example, while selling goods on credit to any customer, the attention is paid on his financial position and not on his character and conduct, which are also important.

2. Do not reflect price level changes:

Usually, in the financial statement, price level change is pot included therefore, it may give confusing and misleading results. The analysis while interpreting should keep in mind, the changes in the price level.

3. Represents only a relative position:

Ratios only exhibit a relative position. Therefore, ratios should be understood as substitution of figures or data. There can be sufficient difference between actual figures and ratios.

4. Limited use of a single ratio:

Only one ratio does not exhibit the whole picture of any position. Therefore, without thinking overall ratios related to the presented problem the conclusions drawn on the basis of only one ratio can present confusing picture. Thus, it is necessary that while drawing conclusions all related ratios be thought over.

Question 5.

What do you understand by profitability ratio and sales ratio ?

Answer:

Profitability ratio:

Business is established for earning profits. Profit is necessary for the progress and the development of the business. All the concerned parties related to business are benefited by the profitability ratio. The owner of the business who has invested capital expect return on his capital in the form of profit, the creditors feel assured about the return of their money by profitability and the salary, bonus etc. of the employees also depend upon the profitability ratio of the business.

Sales ratio:

The analysis of profitability can be done on the basis of the sales. The profitability of the business calculated on the basis of sales is justified. The following ratios are calculated under it.

Gross Profit ratio:

This ratio establishes the relation between gross profit and net sales. The computation of this profit is done by deducting direct expenses related to the cost of the goods sold out of net sales. The contribution of gross profit will be more in the net profit when the gross profit will be high. It is calculated as under:

If gross profit is not given then it can be calculated as Sales – Cost of goods sold. Cost of goods sold = Opening stock + Purchases + Direct expenses – Closing stock. Gross profit = Sales + Closing stock – (Opening stock + Purchases + Direct expenses) or Gross profit = Sales – Cost of goods sold.

Net sales is calculated as Net sales = Total sales – Sales returns.

Net profit ratio:

Net profit ratio before tax and after tax establishes the relation between Net profit and Net sales. The objective of computation of this ratio is to determine the efficiency of the whole activities of the institution. In other words to determine the over all profitability. The following point highlight its importance:

- It is also known as the margin of net profit.

- This ratio reveals what part of sales is utilized for generating dividend and how many share is utilized as reserves.

- The financial position of the institution is favorable to face the financial conditions or not.

- Cost of production is increasing due to sale price, demand is decreasing due to production, then what part of sales could be left to face such situation.

- High net profit ratio is a symbol of favorable condition of the institution to face any adverse circumstances. If the ratio is low then it is hot fit for such circumstances.

Final Words

So friends, how did you like our post! Don't forget to share it with your friends below the sharing button post. Apart from this, if there is any problem in the middle then do not hesitate to ask in the comment box. We will be happy to assist you. We will keep writing more posts related to this. So don't forget to bookmark (Ctrl+D) our blog “various info: Education and Tech” on your mobile or computer and subscribe us now to get all the posts in your email.

If you liked this post then don't forget to share it with your friends. You can help us reach more people by sharing it on social networking sites like WhatsApp, Facebook or Twitter. Thanks!

If you liked the information of this article, then please share your experience by commenting. This is very helpful for us and other readers. Thank you