Students who are planning to learn and understand the topics of MP Board Class 12th Business Studies Important Questions Chapter 1 Accounting for Non-profit Organization for free from this page. Make sure you use them as reference material at the time of preparation and as a good grade in the final exam. Students who find it difficult to learn English concepts can take the help of this MP Board Class 12th Business Studies Important Questions Chapter 1 Accounting for Non-profit Organization PDF and Answer all Questions in the exam easily. Go through the below sections and get the MP Board Class 12th Business Studies Important Questions Chapter 1 PDF. Students can also download MP Board 12th Model Papers so that you can revise the entire syllabus and get more marks in your exams.

MP Board Class 12th Accountancy Important Questions Chapter 1 Accounting for Non-profit Organization

Accounting for Non – profit Organization Important Questions

Accounting for Non – profit Organization Objective Type Questions

Question 1.

Choose the correct Answer:

Question 1.

Advance Subscription received during a year is a:

(a) Income

(b) Expenses

(c) Liabilities

(d) Assets.

Answer:

(c) Liabilities

Question 2.

Receipts and payment account is prepared by:

(a) Firms

(b) Sole Trader

(c) Company

(d) Non-trading Concern.

Answer:

(d) Non-trading Concern.

Question 3.

Loss on sale of machine will be recorded in:

(a) Receipts & Payment A/c

(b) Income & Expenditure A/c

(c) Balance Sheet

(d) None of these. A/c

Answer:

(b) Income & Expenditure A/c

Question 4.

Entrance fee if no specific instruction is given will be treated as:

(a) Capital item

(b) Revenue item

(c) Assets

(d) None of these.

Answer:

(b) Revenue item

Question 5.

The system of accounting used by non-trading concern and professional person:

(a) Single Entry System

(b) Double Entry System

(c) Mixed Accounting System

(d) Cash System.

Answer:

(d) Cash System.

Question 6.

Balance Sheet is a:

(a) Statement

(b) Account

(c) Account & Statement

(d) None of these.

Answer:

(a) Statement

Question 2.

Fill in the blanks:

- Opening Balance Sheet is prepared when opening balance of is not given…………….

- The first (debit) side of Income & Expenditure Account shows ………………

- Non-trading concern maintain their of account by ……………

- Receipts and payment account is a summary of ……………

- The aim of ……………… is not to earn profit

Answer:

- Capital fund

- Expenditure

- Cash System

- Cash book

- Non-trading Concern

Question 3.

Match the columns:

Answer:

- (d) Opening Capital

- (a) Non-trading Concern

- (e) School

- (f) Real Account.

- (b) Nominal Accounts

- (c) Receipts & Payment A/c

Question 4.

Write true or false:

- Receipts and payment account is like profit and loss account.

- Among the various fund provided by government, scholarship given to the students will be debited in Income Expenditure Account.

- If Sport Fund is shown then all the expenses related to sports will be shown in debit side of Income and Expenditure Account.

- Receipts and Payment Account does not show the difference between capital and receipts.

- The Receipt and payment account is a summary of all capital receipts and payment.

- Donation for specific purpose will be always capitalized.

- Receipts and payment account only record the revenue matured receipts and payment.

Answer:

- False

- False

- False

- True

- False

- True

- False.

Question 5.

Write the Answer in one word/sentence:

- Income & Expenditure account is prepared on the basis of which account ?

- Which type of institution prepare Income Expenditure account ?

- Persons who earn income utilizing their intelligence and skills are called as ?

- Non-trading concern keep their accounts by which system ?

- Account which is the summary of cash book is known as ?

Answer:

- Receipts & Payment A/c

- Non-trading Concern

- Professional person

- Cash system

- Receipts & Payment A/c

Accounting for Non – profit Organization Very Short Answer Type Questions

Question 1.

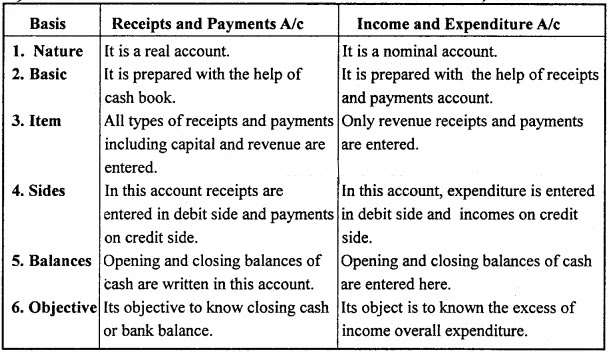

Write one important difference between receipts and payment account and Income and Expenditure account

Answer:

Receipts and payment account is a real account while Income and Expenditure account is a nominal account.

Question 2.

Write any one basis of difference between trading concern and non-trading concern.

Answer:

Aim of non-trading concern is to serve the society while the aim of trading concern is to maximize profit.

Question 3.

What do you mean by non-trading concerns ?

Answer:

Non-trading concerns are those concerns, whose aim is not to do business and earn profit but to serve the public. It includes hospitals, clubs, schools and colleges, etc.

Question 4.

Write the names of incomes and expenses of a non-trading concern.

Answer:

The following are the incomes and expenses of a non-trading concerns : Income : Annual membership fee, charity, interest, rent from sublet, income from the sale of waste materials, etc.

Expenses : Stationery, wages, charity, postal charges, electricity charges, subscription to newspapers, etc.

Question 5.

What do you mean by receipt and payment account ?

Answer:

Receipt and payment account is the summary of cash book in which all receipts are debited and all the payments are credited. In receipt and payment opening balance and closing balance of cash is also shown.

Question 6.

Why non-cash transactions are not entered in receipts and payment ac¬count ?

Answer:

Non cash transactions are not entered in receipts and payment account because it is prepared on the basis of cash book of accounting.

Question 7.

What do you mean by income and expenditure account and by whom it is prepared ?

Answer:

Income and expenditure account is a type of profit and loss account, which is prepared at the end of the accounting year with the help of receipts and payments by the non-trading concerns. Income and expenditure account is prepared by non-trading institutions and professional persons to know their annual income and expenditure.

Question 8.

What is the nature of income and expenditure account ?

Answer:

Income and expenditure is a nominal account.

Question 9.

Which account is prepared by non-trading concern is place of profit and loss account ?

Answer:

Income and expenditure account is prepared in place of profit and loss account.

Question 10.

What is surplus in income and expenditure account ?

Answer:

Excess of income over expenditure refers to surplus in an income and expenditure account.

Question 11.

What is the basis of preparing income and expenditure account ?

Answer:

Income and expenditure account is prepared on accrual basis.

Question 12.

A school collected Rs. 50,000 as donation for the construction of buildings. In which side of school’s balance sheet will it be showed ?

Answer:

In the liabilities side of balance sheet.

Question 13.

Following balance appeared in the books of Modern club in the beginning of the year :

- Fixed assets Rs. 50,000,

- Bank overdraft Rs. 5,000,

- Subscribed received in advance Rs. 2,000.

- Prepared rent Rs. 1,000.

Find the opening capital.

Answer:

Capital fund = Rs. 50,000 + Rs. 1,000 – Rs. 5,000 – Rs. 2,000

= Rs. 51,000 – Rs. 7,000 = Rs. 44,000.

Accounting for Non – profit Organization Short Answer Type Questions

Question 1.

What is life time membership fees ?

Answer:

In non-trading organization some person becomes the life time member of the firm. The fee taken from such kind of persons is called as life time membership fee. This fees is not for a particular year but for the whole period. So it is treated as capital receipts and added to capital fund. It is also shown separately in the liabilities side.

Question 2.

What do you mean by endowment fund ?

Answer:

The cash or assets received by the members of the concern from the third person is called ‘endowment fund’. It is of capital nature, hence is written in receipt and payment account and is Shown in liability side of balance sheet.

Question 3.

state the meaning of ‘Not – for – Profit’ Organizations.

Answer:

Not – for – Profit Organizations (NPO) are set up with the prime objective of providing services and not to earn profit thereby enhancing the welfare of society. Such organizations include schools, hospitals, trade unions, religious organizations, etc. The person/s or the groups of individuals who govern and manage the working of an NPO are known as trustees.

NPO’s main sources of income are donations, subscriptions, life membership fees, grants etc. As these organizations are not set up with profit motive, they do not prepare Trading and Profit and Loss Account. Instead, they maintain Receipt and Payments Ac-count, Income and Expenditure Account and Balance Sheet.

Question 4.

State the meaning of Receipt and Payment Account.

Answer:

Receipts and Payments Account is a summary of the Cash Book. All cash receipts are recorded on the Receipts side (i’. e., Debit side) and all cash payments are recorded on the Payments side (i.e., Credit side) of Receipts and Payments Account. It is prepared on the basis of cash and bank transactions recorded in the Cash Book. It begins with the opening balance of cash and bank and ends with the closing balances of cash and bank (balancing figure) at the end of the accounting period.

It records all cash and bank transactions both of capital and revenue nature. It not only records the cash and bank transactions relating to the current accounting period, but also the cash and bank receipts (or payments) received during the current accounting period that may be related to the previous or next accounting period. This account only helps us to ascertain the closing balance of the cash and bank and helps in assessing the cash position of an NPO.

Question 5.

State the meaning of Income and Expenditure Account.

Answer:

Income and Expenditure Account (I&E) is similar to the Profit and Loss Account in the sense that while the former is prepared to ascertain surplus or deficit during an accounting period, the latter is prepared to ascertain net profit or net loss incurred during an accounting period. I&E Account is a nominal account and is prepared on the accrual basis. It records all transactions of revenue nature that are related to the current accounting period (whether outstanding or prepaid) for which the books are maintained.

All expenses and losses are recorded on the debit side (Expenditure side) and all income and gains are recorded on the credit side (Income side) of I&E Account. The closing balance or the balancing figure of I&E Account is termed as surplus (or deficit), if the sum total of the Income side exceeds (is lesser than) the sum total of the Expenditure side.

Question 6.

Write the objective of receipts and payment account.

Answer:

Following are the objectives of receipts and payment account:

- Knowledge of cash: This account is summary of cash book on the basis of which the closing cash balance for a certain period can be known.

- Knowledge of cash receipts: By the help of this account the cash receipts of the organization at the beginning, mid of the year and at the end of the year can be easily found out.

- Knowledge of cash payments: Receipts and payment account shows all the cash payments made by the organization at the end of the year.

- 4. Basis of income and expenditure a/c: With the help of receipts and payment account, income and expenditure account is prepared.

What is subscription? How is it calculated?

Answer:

subscription is the main source of income for an NPO besides entrance fees, donations, grants, etc. Subscriptions refer to the amount of money paid by the members on periodic basis for keeping their membership with the organization alive. It is paid monthly, quarterly, half yearly or annually by the members.

It is shown in the debit side of the Receipt and Payment Account with the total amount received during the year that may be related to the current period and to the previous and next accounting period. While calculating subscription for the current period, advance subscription received for the current period in the previous period and outstanding subscription for the current period are added to the subscription received during the current period.

Whereas, on the other hand, advance subscription received for the next accounting period during the current period and outstanding subscription for the preceding period are deducted from the subscription received during the current period.

Calculation of Subscription:

Subscription received during the year

Add: Subscription received (in advance) during previous year for current year

Add: Subscription outstanding at the end of the year

Less: Subscription received in advance for the next year

Less: Subscription outstanding for the previous year

## Subscription shown in Income and Expenditure Account

This subscription is related to the current accounting period and is shown in the In-come side of the Income and Expenditure Account.

Question 8.

What is Capital Fund? How is it calculated?

Answer:

Capital fund is the excess of NPOs’ assets over its liabilities. In other words, the excess of assets over the liabilities for a profit earning organization is termed as capital and the same for an NPO is termed as capital fund. Any surplus or deficit ascertained from Income and Expenditure account is added to (deducted from) the capital fund. It is also termed as Accumulated Fund.

Calculation of Capital Fund

Capital Fund at the beginning of the year

Add: Surplus from Income and Expenditure Account

Add: Subscription Amount (Capitalized amount)

Add: Life membership fee.

Less : Deficit from Income and Expenditure Account

Capital Fund at the end of the year

Question 9.

Explain the statement: “Receipt and Payment Account is a summarized version of Cash Book”.

Answer:

Receipts and Payments Account is a summary of the Cash Book. This account is prepared by those organizations which maintain their books on cash basis. All cash receipts are recorded on the Receipts side (i.e., Debit side) and all cash payments are recorded on the Payments side (i.e., Credit side) of Receipts and Payments Account. It is prepared on the basis of cash and bank transactions recorded in the Cash Book.

It begins with the opening balance of cash and bank and ends with the closing balances of cash and bank (balancing figure) at the end of the accounting period. It records all the cash and bank transactions both of capital and revenue nature. It not only records the cash and bank transformations relating to the current accounting period, but also cash and bank receipts (or payments) received during the current accounting period that may be related to the previous or next accounting period.

This account only helps us to ascertain the closing balance of the cash and bank and helps in assessing the cash position of an NPO. It also forms the basis for the preparation of Income and Expenditure Account.

Question 10.

What steps are taken to prepare Income and Expenditure Account from a Receipt and Payment Account ?

Answer:

The following steps are taken to prepare Income and Expenditure Account (I&E) from Receipts and Payment Account (R&P).

Step 1:

All the revenue expenditures paid for the current accounting period are transferred from the Payments side of R&P to the Expenditure side of I&E.

Step 2:

All the revenue receipts for the current accounting period are transferred from the Receipts side of R&P to the Income side of I&E.

Step 3:

Expenses outstanding for the current period and expenses paid in advance (prepaid expenses) for the current period in the preceding accounting periods are to be added (adjusted) to their related expenses in the Step 1.

Step 4:

Income outstanding (accrued income) for the current period and income re-ceived in advance for the current period in the preceding accounting periods are to be added (adjusted) to their related incomes in Step 2.

Step 5:

Non-cash items like depreciation, appreciation for the current accounting period are to be adjusted in the I&E.

Step 6:

After adjusting all the revenue items for the current accounting period, the Income and the Expenditure sides are totaled. If the sum total of the Income side exceeds (or is lesser than) the sum total of the Expenditure side, then the balancing figure is termed as surplus (or deficit).

Accounting for Non – profit Organization Long Answer Type Questions

Question 1.

Differentiate the receipts and payments account and cash account, (any 2)

Answer:

Difference between receipts and payments account and cash account:

Receipts and Payments A/c:

- It is maintained by non-trading concerns.

- It is a summary of cash account.

- Income and expenditure account is prepared from it.

- Date is written at the top along with the heading.

Cash A/c:

- It is prepared by both the trading and non-trading concerns.

- It is main account and write daily.

- Receipts and payments account is prepared from it.

- Date is written along with each transact-ion.

Question 2.

“Income and Expenditure Account of a Not – for – Profit Organisation is akin to Profit and Loss Account of a business concern”. Explain the statement.

Answer:

Income and Expenditure Account (I&E) is similar to Profit and Loss Account (P&L), in the sense that the former is prepared by Not-for-profit-Organisations and the latter is prepared by profit earning organisations. Both the accounts are prepared on the accrual basis.

Similar to the P&L, all the expenses and losses pertaining to the current accounting period are recorded on the debit side (Expenditure side) and all the gains and income of the current accounting period are recorded on the credit side (Income side) of the I&E.

The balancing figure of the I&E is surplus or deficit and that of the P&L is net profit or net loss. Both the accounts record only revenue items which are related to the current accounting period. Similarities between Income and Expenditure Account and Profit and Loss Account I&E Account of an NPO is akin to the Profit and Loss Account of a profit earning business in the following manners.

1. Nature of Account: Both the concerned accounts are nominal in nature.

2. Basis of Recording: Both the accounts record only revenue expenses and revenue income related to the current accounting period. The items of capital nature are not ignored while preparing these accounts.

3. Period: Transactions related to current year are recorded in Income and Expenditure account in the same manner in which profit and loss account is prepared. Transactions related to previous year or next year are excluded.

4. Adjustments: The treatment of adjustments like, outstanding expenses, prepaid expenses, income received in advance, income due but not received, depreciation, bad debts etc. is same as that in Profit and Loss Account. Thus, both the accounts are prepared on the accrual basis.

Question 3.

Why does non-trading concerns maintain their accounts on the basis of cash system ? Given any five reasons.

Answer:

Due of the following reasons, non-trading concerns are maintaining these books of accounts according to the cash system of book-keeping.

- Easy method: Cash system is in easy method. It is a part of cash-book and its is maintained as a cash-book is prepared.

- Less expensive system: Under this method, no need for keeping more accounts. Even untrained and un experienced persons can do this work.

- Limited transactions: In non-trading concerns, the number of receipts and payments are limited.

- Cash transaction: Only cash receipts and payments are entered here as in the cash-book. If there is more credit transactions it will be entered in memorandum book.

- Checking of correctness: Correctness can be checked by comparing with cash-book.

Question 4.

What points should be kept in mind while preparing the receipts and payments account ?

Answer:

The following points should be kept in mind while preparing receipts and payments account:

- In this account, enter first of all the opening cash balance. This balance might be closing balance of the previous year.

- Only cash transaction, i.e., cash receipts and payments are entered and no credit transaction.

- All types of capital and revenue nature transactions are entered here.

- All types of receipts and payments whether they relate to previous, current or coming year should be entered.

- No adjustment relating to outstanding, prepaid, as earned and accrued are done here.

Question 5.

Differentiate the receipts and payments account and income and expenditure account ? (any 4 points)

Answer:

Differences between receipts and payments and income and expenditure

Question 6.

Describe in brief the sources of income of non-trading concern.

Answer:

The various sources of income of non trading concern are :

(a) Subscription:

Subscription is the main source of income for the non-trading concern. It is the amount paid by the members of the organization monthly or yearly for keeping their membership with the organization alive.

(b) Donation:

Donation refers to the amount received by the organization as gift from the members or outsiders. If the amount of donation is merge, it will be treated as revenue income. But if the amount is huge and for specific purpose, then it is treated as capital receipt.

(c) Entry fee:

Amount paid by new member at the time of joining an organization is known as entry fee. It is paid by every member once at the time of becoming a member of the organization.

(d) Interest:

For increasing its sources of income, these non-trading organization invest money outside. The interest earned on this investment is also a source of income.

(e) Income from entertainment:

These organization organize various types of cultural programmes and collected income from the common people.

(I) Rent received:

By giving the building or some other portion in rent, the rent received is also a source of income for them.

Question 7.

What are the process of preparing income and expenditure account from receipts and payments account ?

Answer:

The following is the process of preparing income and expenditure account from receipts and payment account:

(a) Opening cash and bank balance:

It is not entered in income and expenditure account. It is shown in assets side of opening balance sheets.

(b) Closing cash and bank balance:

It is not recorded in income and expenditure account. It is shown in assets side of closing balance sheet.

(c) Capital receipts:

Capital receipts are not entered in income and expenditure account. It is shown in liabilities side of closing balance sheet. Example of capital receipts are donation fund, sports fund, prize fund etc.

(d) Reserve and fund:

Reserve and funds are not recorded in income and expenditure account. It is shown in liabilities side of balance sheet and the concerned expenses are deducted from it.

(e) Sale of fixed assets:

Sale of fixed assets is not shown in income and expenditure account. It is entered in assets side of balance sheet by deducting if from concerned assets.

(f) Capital payments:

Capital payments are not entered in income and expenditure account. It is shown in assets side of closing balance sheet. Example of capital payments are purchase of assets, investment fixed deposits etc.

Question 8.

How is capital fund ascertained in non-trading organization ?

Or

How is initial capital ascertained in non-trading organizations ? Explain.

Answer:

For calculating initial capital, an opening balance sheet is prepared with the help of last year’s assets and liabilities. The total of liabilities side is deducted from the total of assets side and the difference thus gained is called initial capital.

Capital = Total assets – Total liabilities on opening date.

Final Words

तो दोस्तों आपको हमारी पोस्ट कैसी लगी! शेयरिंग बटन पोस्ट के नीचे इसे अपने दोस्तों के साथ शेयर करना न भूलें। इसके अलावा अगर बीच में कोई परेशानी हो तो कमेंट बॉक्स में पूछने में संकोच न करें। आपकी सहायता कर हमें खुशी होगी। हम इससे जुड़े और भी पोस्ट लिखते रहेंगे। तो अपने मोबाइल या कंप्यूटर पर हमारे ब्लॉग “various info: Education and Tech” को बुकमार्क (Ctrl + D) करना न भूलें और अपने ईमेल में सभी पोस्ट प्राप्त करने के लिए हमें अभी सब्सक्राइब करें।

अगर आपको यह पोस्ट अच्छी लगी हो तो इसे अपने दोस्तों के साथ शेयर करना ना भूलें। आप इसे व्हाट्सएप, फेसबुक या ट्विटर जैसी सोशल नेटवर्किंग साइटों पर साझा करके अधिक लोगों तक पहुंचने में हमारी सहायता कर सकते हैं। शुक्रिया!